The Committee, formed by the International Financial Services Centres’ Authority (IFSCA) of India, submitted its SAFAL (Ship Acquisition, Financing, and Leasing) Report in October 2021. The report includes a set of critical and necessary reforms and a roadmap in order to bring the lucrative and greenfield business of ship leasing to India through the SEZ jurisdiction of IFSC located at GIFT City in Gandhinagar and to realise the shipping industry’s full transformational potential. It concludes that the time is opportune for imparting a brand value to India-flagged vessels. This can be done by carving out a share in global-cross trades, securing gainful transactions for India’s marketplace, promoting decarbonization and greening of the blue oceans, and leveraging India-IFSC Maritime to achieve the Maritime India Vision 2030 and beyond.

The Report contains the results of a holistic 360-degree examination of the shipping value chain and of the financial models developed to reveal the gaps in the cost-effectiveness of ship owning and ship leasing from the India-IFSC regime (both extant and post-changes) vis-à-vis the global maritime hubs. Keeping in view the old adage “all for the want of a horseshoe nail, a kingdom was lost,” it brings out the essentiality of the supportive links of ship building, flagging of tonnage, operations, and repairs and recycling for seeding the ship chartering and leasing business in India. It drew upon the experience gained with the swift and successful seeding of the aircraft leasing industry from India-IFSC (under the Rupee Raftaar project), finding that within a year since IFSCA notified the new legal and regulatory framework, as many as 17 aircraft lessors had already established themselves, executed five aircraft leasing contracts, and have another 40 to 45 contracts in the works.

Essentially, the report has recommended that the concept of IFSC-SEZ, conceived for financial services, be extended to SAFAL products and services, including ancillaries. This may entail notifying the lease of any equipment (ships, container-boxes, etc.) as a ‘financial product’ to enable ship leasing entities to set up a unit in IFSC. Drawing upon global best practices, changes in certain direct and indirect taxes have been suggested. For attracting India-IFSC enterprises in global cross-trades and India’s exports, a new category of “Indian IFSC-controlled tonnage” has been suggested to be introduced, with global benchmarking of regulation, tonnage tax and other taxes, and seafarer regimes, which would also help overcome pricing and other limitations of the existing “Right-of-First-Refusal (ROFR)” regimes for India’s imports of bulk cargoes and coastal trade. It has recommended a slew of financial measures to enable the significant participation of the otherwise shy Indian banks, NBFCs, and AIFs in ship finance and in the build-up of India’s operational tonnage, including India-built tonnage, through arrangements such as sale-and-lease-back with India-IFSC lessors. A regime for dispute resolution has also been fleshed out.

A number of direct tax changes recommended by the Committee have already been accepted and announced in the Union Budget for 2022–23. On its part, the IFSCA has notified “ship lease” as a financial product on January 7th ,2022, and the overseas investment rules and regulations on August 22nd, 2022, which will boost the participation of Indian entities in the IFSC. The Framework for establishing ship leasing entities in India-IFSC has also been released on 16th August 2022.

Fig. 1 summarises the key attractions and incentives envisaged in India-IFSC Maritime, covering legal and regulatory domains, direct and indirect taxes, ship finance, and ease of doing business.

Thus, India-IFSC has the strong potential to become the financial and technology gateway of India for the world, starting with bankable large mobile equipment (aircraft, ships, container-boxes, metro and railway rolling stock, satellites, etc.). Indian-IFSC controlled tonnage is the instrument for making a mark in global maritime cross-trades, finance and insurance, and arbitration and dispute resolution.

India Shipping—the Crux of the Problem

Brand values are built and nurtured. Shipping, as a global industry, experiences cyclical ups and downs where the asset value is linked to global charter hire rates (and cost of ship finance) and regulatory ease for ship ownership, flagging, and operations.

Independent India could not develop a base for global commercial maritime enterprise anywhere along its vast coastline despite also having a huge and growing domestic market and international seaborne trade, deep-rooted maritime traditions, and skilled seafarers. India is a country of charterers rather than ship-owners. It is a net importer of shipping services and ship finance, spending USD 75 billion annually on chartering foreign-flag vessels for its EXIM trade.

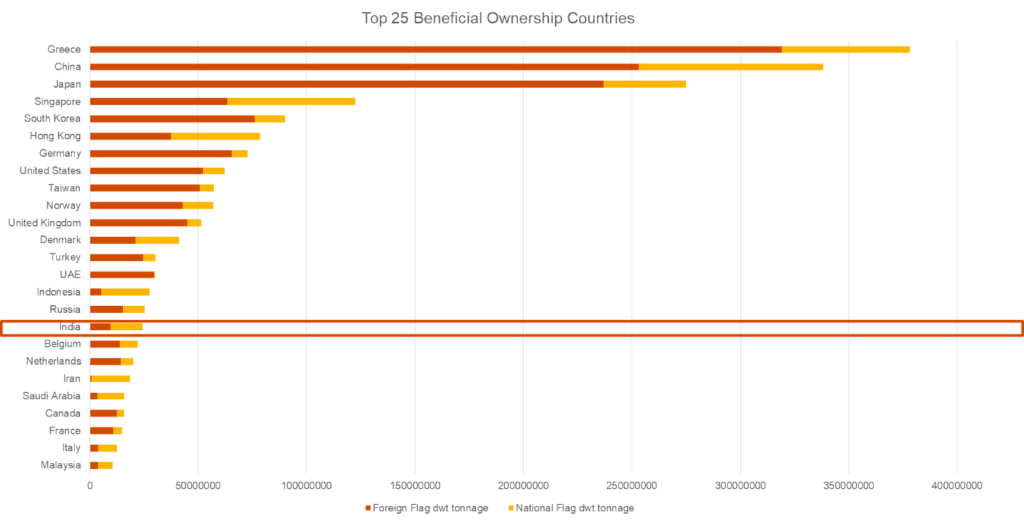

Source: Menon Economics and DNV GL publication

India lags way behind these global maritime leaders. Indian entrepreneurs have not considered investing in the shipping sector as a safe and lucrative haven. Most of its leading ship-owners and operators have shifted their operations, with foreign flags of convenience (Panama, Marshall Islands, Liberia, etc.), to certain foreign maritime hubs in India’s vicinity (Dubai, Hong Kong, and Singapore)—that attract commercial enterprise by providing a competitive tax regime and an integrated and holistic shipping services platform (covering maritime finance, technology, insurance, arbitration and dispute resolution, shipbroking, crew training, and ship management) in their respective jurisdictions.

Ship financing and insurance costs and cumbersome regulatory procedures in India compare unfavourably with global hubs. India’s tax regimes on shipping enterprises are unattractive, unlike those of Singapore, Malta, Cyprus, and Panama, where the majority of international carriers are registered. Indian seafarers sailing on foreign ships are exempted from paying income tax in India, but are liable to pay all taxes when sailing on Indian ships. Similarly, the GST provisions on ship building, ship managing, bunkering, repairing, etc. are skewed in favour of foreign entities, rendering Make-in-India unattractive.

In summary, the reforms recommended in the October 2021 Report are aimed at seeding a robust ship acquisition, financing, and leasing regime in India-IFSC, which enables competitive delivery of shipping services on ships owned and/or leased by India-IFSC units. The regime must be world-class and globally integrated, where capital, expertise, and tools are readily available at globally competitive terms. A vibrant ship finance regime, with foreign participation, in India-IFSC will enable India to keep abreast of sector developments, making it future-proof so that it can steadily ride the tailwinds of innovations over time towards decarbonisation through “green financing”, besides carrying a self-sustaining impetus for the medium to long term.

“India-IFSC Controlled Tonnage” and Flagging of Vessels

Meaningful growth in the Indian owned and flagged tonnage has not been realised despite the advent of 100 per cent FDI in shipping, the tonnage tax regime, tax on dividends from overseas subsidiary, and several incentives, including the combined effects of ‘right of first refusal (ROFR) for Indian cargoes and coastal cargo reservations. Curiously, while the number of vessels flagged in India increased in the last four years from 1,741 to 1,802 vessels in 2021, the tonnage carrying capacity declined from 11.2 m.GT to 10.4 m.GT (out of a world total of 1,468 m.GT). Indian vessels have a high average age at 19.3 years. In contrast, the Top-10 flag States (07 of whom have open registries) have about 40% of the fleet by numbers but 75% of the world’s tonnage capacity. In terms of cargo-carried shares, as of August 2021, only 61% of its total cargoes (including domestic coasting and offshore fields) was carried on ships owned and registered in India.

Source: Clarksons’ Research, August 2021

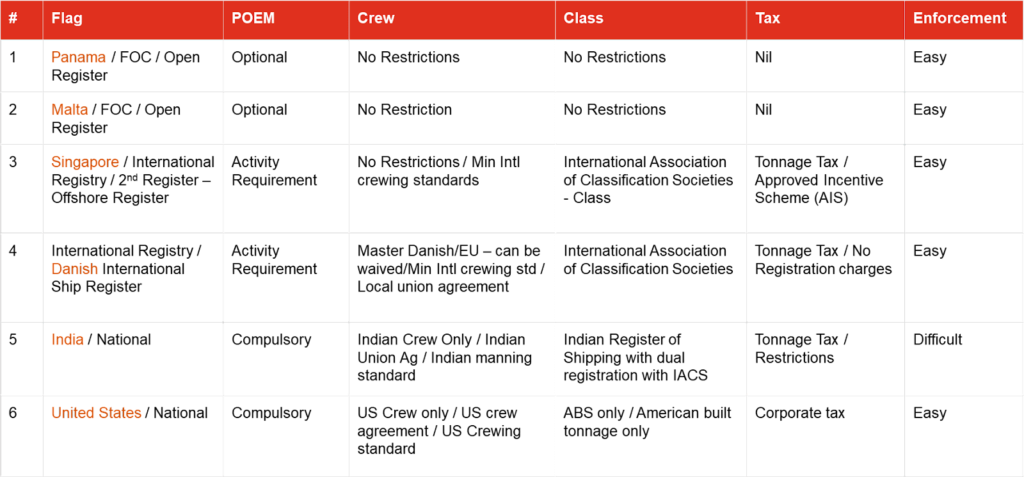

The ground reality is that, though beneficial ownership of vessels still lies with traditional ship-owning countries, owners have increasingly flagged out their tonnage to open registries, which enjoy good ratings having improved their safety records in collaboration with Classification Societies. It is seen that, presently, there is no binding international framework to regulate the hubs. The 1986 UN Convention on Conditions for the Registration of Ships, which contains many international standards for the registration of vessels in a national registry, has not yet entered into force.

In direct response to the growth of open registries, the traditional national or “closed” registries have started creating their own “offshore” or “second” registries”. Such a second registry is often at a different geographical location within its jurisdiction. It has fewer onerous requirements for crewing, class, taxation, etc., while attempting to strike a balance between safety and providing more options to the owners. The suggestion that the Indian Register of Ships (IRS) should enable a competitive regime from India-IFSC is in sync with this trend.

In terms of the link between ship registration and flagging, it is seen that a vessel can be registered under the flag of India only if all ten shares of the vessel are held by an Indian individual/corporation. Joint ownership is permitted on the condition that all the owners are Indians. While the Merchant Shipping Act (MSA) does not specifically prevent an Indian vessel from flagging out, its Place-of-Effective-Management (POEM) must be in India.

DG Shipping has also created a new category of “Indian controlled ships”, with the flagging of ships owned by Indian entities outside India. However, there are two critical restrictions for entities acquiring vessels flagged outside India. Firstly, as per DGS Order 10 of 2014, the tonnage flagged outside India shall not exceed the tonnage owned under the Indian flag. Secondly, as per DGS Order 10 of 2014, 50 per cent of the crew engaged on the vessel, as per the Safe Manning Document or actual deployment, whichever is higher, shall be Indian. Further, entities operating on the Indian coast or offshore fields are required to engage trainees, officers, and cadets as per the Tonnage Tax Scheme, whereby the training commitment shall be as per the Tonnage Tax Scheme, if applicable. A clearly seen outcome of tonnage and crew restrictions is restricted growth in Indian tonnage capacity. To circumvent these restrictions, most Indian entities still prefer setting up offshore vehicles in foreign jurisdictions, where they are freely allowed to acquire foreign vessels.

Thus, it has been proposed in the report that DG Shipping should introduce a new category titled “Indian IFSC controlled tonnage”, offering certain relaxations in line with global best practices to help overcome challenges and impediments in the existing DTA regime. Besides new tonnage being registered with IFSCA by an IFSC unit, Indian tonnage registered presently in the DTA zone could also transit to the IFSC regime, provided that the vessel is presently deployed in global cross-trades or is a specialised vessel (for research and exploration, etc.), its size is 15,000 dwt or more, and the vessel age is not more than 15 years. These provisos are to prevent tax arbitrage by deploying all old DTA tonnage as ‘new’ IFSC tonnage. A foreign company could also set up its ship leasing as an IFSC unit, with POEM in IFSC.

In keeping with global best practices, all such IFSC units (Indian and foreign WOSs) would be freely permitted to opt for the Indian flag or foreign flag (which has not been banned by DG Shipping for safety or security reasons). In crewing, while promoting onboard training of at least 1 cadet (and at least 50% of crew of Indian nationality in coastal trades), reciprocal fair and equitable arrangements with specific foreign flag States have been proposed for participation in coastal cargo and PSU bulk import freight.

Notably, in order to provide a level playing field for new India-IFSC tonnage with DTA tonnage while keeping it competitive vis-à-vis foreign tonnage, its participation in India’s reserved imports and coastal trade when the right of ROFR is exercised, has been proposed as follows:

- If a DTA India flagged vessel is L1 in bidding, then the tender is to be awarded to it and no ROFR is given for India-IFSC vessels.

- If an IFSC India-flagged or foreign-flagged vessel is L1 in bidding, then the tender is to be awarded to an IFSC vessel by waiving the requirement of ROFR for India DTA vessels, with the provision for waiver coming into effect no later than April 1, 2023.

- If a foreign-flagged vessel is L1, the tender is to be awarded as per existing ROFR and price preference. IFSC India-flagged vessels may participate in ROFR. However, if a DTA vessel matches the L1, then the tender is to be awarded to the DTA vessel, else the tender may be awarded to an IFSC India-flagged vessel. IFSC vessels (being more cost-competitive) do not get the right to price preference.

- An IFSC unit may hire DTA India-flagged vessels to participate in tenders.

- If an IFSC unit is participating in the tender, then its overseas parent (being a related party), if any, cannot participate in the tender.

- De-boarding, port clearances, and immigration clearances of foreign crew on such vessels when they enter any Indian port shall be carried out in accordance with applicable DGS instructions.

In brief, the objective of India-IFSC controlled tonnage is to attract affordable foreign capital to accelerate development of India’s tonnage capacity for serving both global cross-trades and India’s domestic and EXIM trade, and simultaneously encourage “ghar vapsi” of the Indian-origin shipping ecosystem presently operating from overseas hubs to the India-IFSC Maritime hub.

The challenges are aplenty, as are the benefits of judicious reform.

It is obvious that restrictions on chartering by Indian entities serve the protective and uncompetitive interests of a few (examination of a PSU bulk importer showed that ROFR served only 10 per cent of total tendered fixtures during the last two years), but could be harming the rest of the shipping sector and egregiously, the wider user industry by deterring them (the bulk PSU-importer, for instance) from obtaining the best freight rates and managing their freight risks by trading freely in an open market. Indian PSUs are willy-nilly forced to pay the additional cost in order to maintain a fleet of Indian-flag vessels in order to avoid their time-chartered vessels losing out under ROFR to Indian-flagged tonnage. An examination of a few cases found that the freight rate bids, unmatched under ROFR, could be 35 to 40 per cent higher than the foreign-flagged L1. Doubtless, additional freight costs for coastal trade due to the restrictions therein would be similarly passed on to the manufacturing and consuming economic segments of India.

It is not the case that only foreign-flagged tonnage is the answer. But, instead of applying restrictions and controls that have served only a few, the pathways for promoting the Indian flag lie in engendering a strong, proactive, commercially-oriented flag management with proper ensuring of compliance with the provisions of Port State Controls and IMO’s instruments; and putting in place a flag regime that provides a competitive tonnage tax regime. An essential element is providing optionality to owners on issues like crewing, class, etc., but without compromising on safety and security standards and simultaneously furthering employment of Indian seafarers. It has thus been proposed in the report that the Indian-flag be made the flag of choice for Indian-IFSC controlled tonnage involved in global and Indian international trade.

It is added that substantial improvement in the ratings and performance of regulatory functions and oversight in an efficient and disciplined manner is vital. It would ensure, for instance, that the Indian flag upgrades itself from its present position at 43 (“Grey List”) to the “White List” by Port State Controls and that the India Administration’s Recognised Organisations (the IRS) also upgrades from “Medium-level” performance (rating and assessment in 2020) to “High-Level”. The exercise of flagging options will certainly bring financial, fiscal, and commercial benefits to the ship owner/lessor in India-IFSC and to a Wholly-Owned-Subsidiary (WOS) of a foreign ship owner/lessor with POEM established in India-IFSC.

Maritime transport is the backbone of international trade and the global economy, serving 80 per cent of global trade in goods by volume and over 70 per cent of its value. The primacy of the USD and the resultant globalisation of the shipping industry have created distinct shipping activities. Further concentration of capital, aided by liberal taxation and regulation, has created global shipping hubs specialising in these activities. Countries like India that could not adapt to these changes became net importers of shipping services from established hubs.

But now, India-IFSC (having trained manpower, deep financial markets, and excellent digital infrastructure) is well-positioned to provide a value-for-money option to all the players in the global shipping ecosystem. Participation in international trade of entities in the India-IFSC Maritime Hub would bring large benefits to the host economy, with tailwinds from output and employment multipliers. Apart from direct payment of tonnage and corporate tax, the hub would also bring in indirect and induced taxable income and revenues.

Shipping is also essential to India, hosting an estimated 95 per cent of India’s goods trade by volume and 70 per cent by value. Yet, the share of Indian ships in carrying India’s EXIM cargo was a mere 6.53 per cent in FY 2019-20. Sizeable Indian-controlled tonnage is either flagged out or POEM of vessels is outside India. India is thus well placed to step up its investment in the shipping industry. Fostering the development of the new lucrative business of ship leasing, financing, and owning in India-IFSC with concerted and timely efforts will also create large opportunities for ship-builders, maintenance, repair, and overhaul organisations, ship recyclers/breakers, ship financiers, accountants, lawyers, arbitrators, valuers, etc., and entities from the commercial trade segment (ship owners, charterers, lessors, ship brokers, etc.).

It is thus expected that the triumvirate of regulatory ease and lower tax burden in leasing ships from India-IFSC, providing facilities and judicious options in doing business to units set up in India-IFSC-SEZ, and convergences with the marine ecosystem of Gujarat Maritime Cluster will also help connect the shipyards with project brokers, while also providing a range of financing options to shipyards. Sale and leaseback structures, recourse to specialised JOLCOs and Chinese leasing structures, etc. can be created at India-IFSC and Indian shipyards and vessel-recyclers can be involved for eventual use by India-IFSC controlled operators/lessors.

In a nutshell, ship leasing and Indian-IFSC controlled tonnage will serve to make India-IFSC the maritime finance and technology gateway for the world and impart a growing brand value to Indian flagged vessels on merit. India-IFSC, akin to an offshore jurisdiction, has certain inherent cost advantages and, through the unique unified regulator (IFSCA), it provides simplicity, transparency, and ease of establishment and operations. Suitable foreign investments and ship finance and insurance at competitive terms are a sine qua non for India’s accelerated presence in global shipping markets. Apart from acting as a hedge against the large freight bills of India’s mercantile trade, holding significant control in global maritime bankable assets can also offer the industry potentially higher returns on investments. For the Indian economy to truly benefit, it is vital that Indian-flagged ships, especially those with POEM in India-IFSC, prominently participate in international trade. A ‘blue water’ merchant fleet controlled by India is an economic imperative.