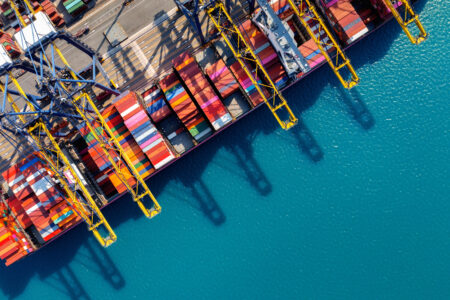

India plans major shipping boost: 300 foreign vessels sought for Indian registry by 2030 to cut logistics costs.

As part of a larger initiative to increase the country’s fleet and lower logistical expenses, India hopes to have at least 300 foreign-owned ships flying the Indian flag by 2030.

About 50 ships are currently being re-flagged, and the procedure is expected to be finished in the next three months, according to the officials. Authorities claim that the readiness of nearly 11 large international shipping lines to switch some of their fleets to the Indian registry is a sign of growing trust in India’s maritime governance and regulatory stability.

A ship can operate under Indian maritime law and be registered in the nation’s shipping registry by re-flagging. According to officials, the programme will enable these ships to transport domestic goods, assist exporters, particularly MSMEs, and improve supply chain resilience in the event of future interruptions. Additionally, it will support keeping a greater portion of freight profits domestically.

It is anticipated that a larger fleet flying the Indian flag will lessen reliance on foreign carriers, limit susceptibility to fluctuating freight costs, and facilitate cost rationalisation for EXIM goods. Officials pointed out that lower transaction and logistics costs will make Indian goods more competitive internationally.

In FY26, the government implemented many policy incentives to speed up re-flagging. These include tax benefits for ships leased through GIFT City and the priority distribution of government goods to ships flying the Indian flag. In addition to announcing concessions on port rates and related marine services, the Union Budget 2025–2026 expanded benefits for Indian ship management companies hiring staff.

A ₹70,000-crore plan for shipbuilding, ship maintenance, and port modernisation was also included in the budget. In order to facilitate long-term financing, tax benefits, and more seamless capital flows, measures intended to foster ongoing fleet expansion and draw international carriers to base more assets in India, shipyards have been categorised as infrastructure.

This policy thrust is being strengthened by large maritime infrastructure projects like the ₹76,000-crore Wadhwan Port and capacity additions at several smaller ports.

International shipping companies have started to react. The French carrier CMA CGM has ordered six LNG-powered 1,700-TEU ships worth ₹3,000 crore at Cochin Shipyard and would register four of its ships under the Indian flag, beginning with CMA CGM Vitoria in April 2025. While Maersk has previously moved Maersk Vilnius and Maersk Vigo from Singapore to India, citing India’s “progressive maritime reforms,” Mediterranean Shipping Co. (MSC) intends to re-flag twelve container ships. Approximately 1,600 merchant ships with a combined gross tonnage of 14 million tonnes are now operated by India. Despite this, the nation only makes up around 2 percent of the world’s fleet capacity and spends close to $75 billion a year on foreign ship chartering.

SOURCE – MARITIME GATEWAY