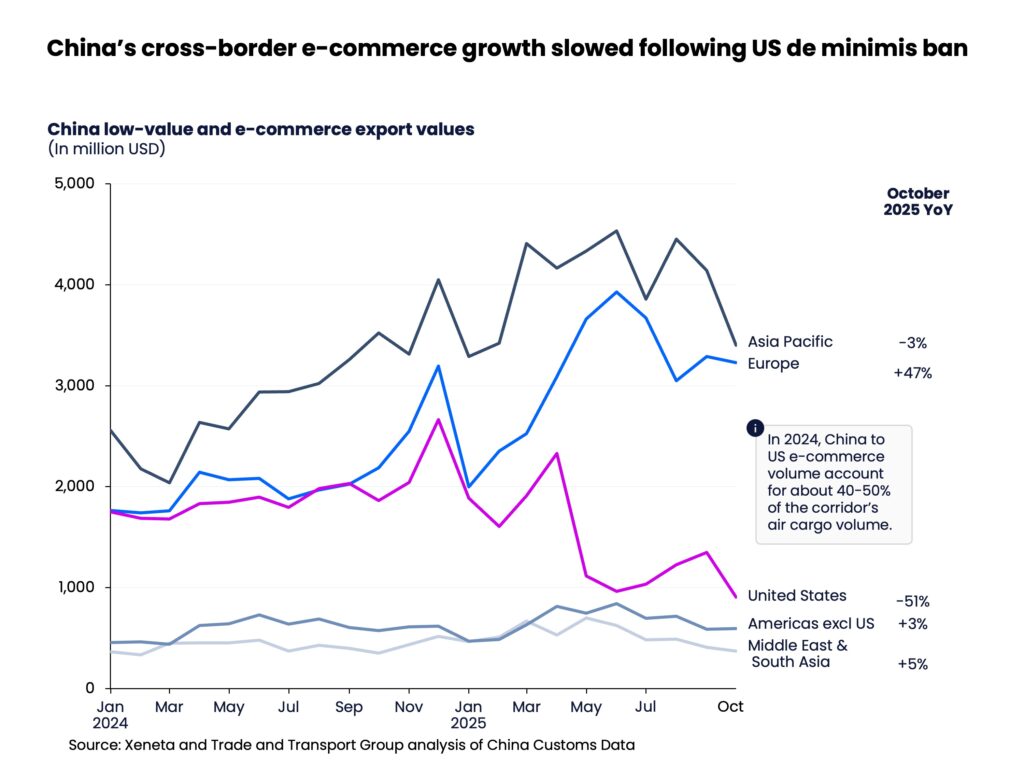

Global air cargo volumes rose 5% in November, but the vital e-commerce ‘growth engine’ is slowing, with flat China cross-border sales.

Global Trends and Rates

Air cargo demand saw a further +5 percent year-on-year (YoY) rise in November, building on surprisingly robust figures from September (+3 percent) and October (+4 percent). This momentum is expected to deliver +4 percent total growth for 2025.

Despite the surge in demand, capacity expansion in November largely matched the increase. This rebalancing led to a -5 percent YoY decline in global cargo spot rates (down to USD 2.73 per kg), suggesting carriers are sacrificing price discipline to chase market share. Month-on-month, the November spot rate increase was only +6 percent, a subdued rise compared to the +9 percent seen a year prior.

Trade Lane Performance

Corridor-level spot rates were lower across all major lanes compared to last year:

- Europe–North America saw its first YoY decline, with rates falling -8 percent.

- Northeast Asia (NEA) corridors proved more resilient due to agile freighter redeployment. Inbound spot rates to North America and Europe from NEA saw only single-digit YoY declines.

- Southeast Asia (SEA) experienced double-digit rate declines to both North America and Europe, reflecting increased capacity deployment and softer volumes linked to e-commerce de minimis restrictions affecting transit hubs.

E-Commerce Growth Engine Stalling

The biggest concern is the slowing of the e-commerce sector, which has been the primary growth driver for the air cargo industry over the last two years:

- China’s total cross-border e-commerce sales were flat in October, following 27 consecutive months of near +40 percent YoY growth.

- Strong expansion from China to Europe (+47 percent in October) was offset by declines to the rest of Asia (-3 percent) and a dramatic -51 percent drop in e-commerce volumes to the US in the new post-de minimis environment.

US Tariffs and 2026 Outlook

While the impact of actually implemented US tariffs (estimated in the 10-12 percent range) is less dramatic than initially feared, higher prices are expected to eventually hit consumer demand and air cargo volumes in 2026.

Xeneta projects a more challenging year ahead, with expectations of only modest, low single-digit demand growth (2-3 percent) in 2026. With supply expected to grow faster than demand, forwarders will likely seek to grab market share, placing further downward pressure on rates.

SOURCE – PR