As we approach 2025, the ocean freight industry is poised for significant shifts. Understanding these changes is crucial for shippers and freight forwarders to navigate the evolving market dynamics effectively. Below is a numerical breakdown of the key factors shaping the ocean freight market and strategies to navigate through them.

Red Sea crisis: Prolonged disruptions ahead

The Red Sea crisis is expected to extend beyond 400 days, with a large-scale return of container ships to the region appearing unlikely. This prolonged disruption necessitates alternative routing strategies and contingency planning to mitigate delays and increased costs.

Labour strikes: Potential impacts on U.S. ports

The suspension of the International Longshoremen’s Association (ILA) port strike action is set to end on January 15, 2025. This development raises concerns about potential labour disputes, which could lead to port congestion and service interruptions, particularly on the U.S. East Coast.

Political shifts: Anticipated tariff increases

The inauguration of President Donald Trump on January 20, 2025, is expected to introduce new and higher tariffs. Shippers should prepare for potential cost increases and supply chain adjustments in response to these policy changes.

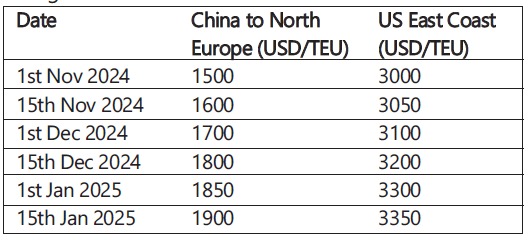

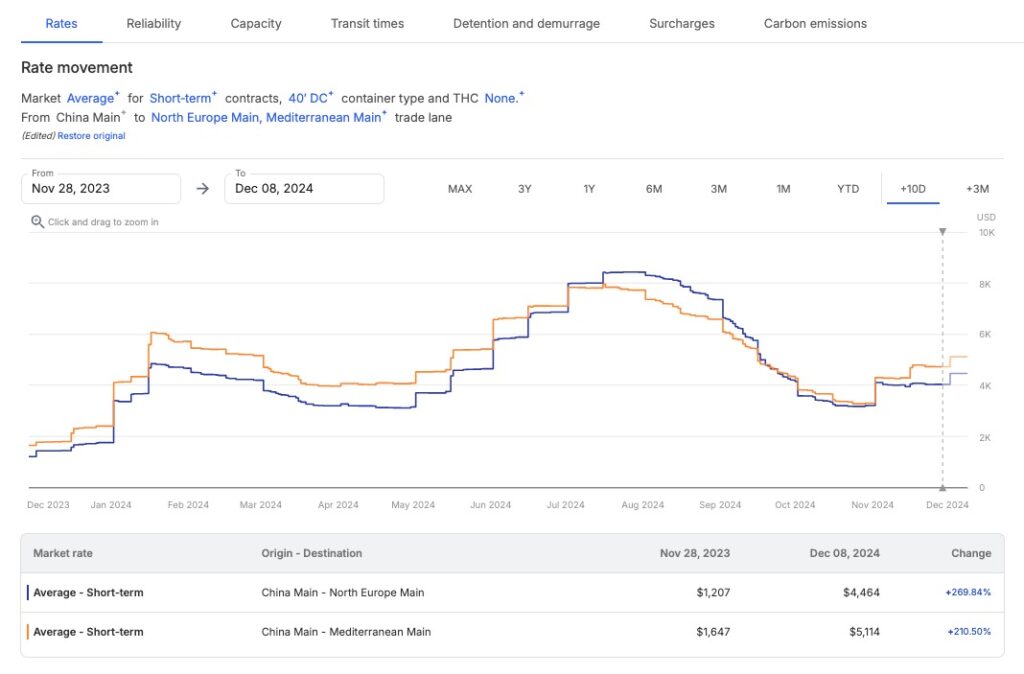

As shown, spot rates for the China to North Europe route have increased by $400 since November 2024, while US East Coast rates have seen a rise of $350. These rate increases could signal a broader trend in global freight pricing.

Lunar New Year: Anticipated supply chain disruptions

The Chinese Lunar New Year begins on January 29, 2025, leading to factory shutdowns and increased demand ahead of the holiday. This period is expected to cause supply chain disturbances lasting until mid-February, affecting inventory levels and shipping schedules.

Alliance restructuring: Service changes expected

Effective February 1, 2025, the Gemini and Premier alliances will come into effect, resulting in the dissolution of THE Alliance and 2M. Shippers should anticipate service changes, potential disruptions, and the need to reassess carrier partnerships to maintain reliable service.

Demand and capacity dynamics: Market volatility

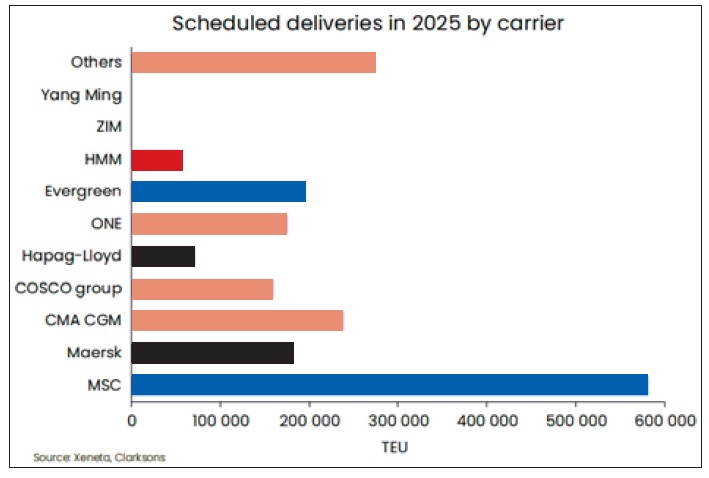

In 2024, TEU demand growth is expected to settle at 4.5%, indicating frontloading to build up inventories. This trend is anticipated to neutralise in 2025, with demand growth predicted to drop to 3%. However, looming tariff wars could lead to higher volumes into the U.S., particularly from China, as shippers attempt to import goods ahead of tariffs. Fleet growth in 2024 reached a 16-year high at 10%, but disruptions like the Red Sea crisis have neutralised the effect of supply growth outpacing demand. Looking ahead, 2025 is expected to see supply growth outstrip demand growth.

Emission impact and regulations

Trades impacted by the Red Sea disruptions have seen a significant increase in carbon emissions throughout 2024, with the Far East to Mediterranean route being the hardest hit. Carriers have increased shipping speeds to compensate for longer sailing distances, directly impacting emissions. In 2025, the International Maritime Organisation (IMO) is expected to make important decisions regarding global carbon emissions pricing and measures to support fleet decarbonisation.

Strategic recommendations for shippers

- Diversify Routing Options: Given the ongoing Red Sea crisis, exploring alternative shipping routes is essential to mitigate delays and potential cost increases.

- Monitor Labour Developments: Stay informed about labour negotiations and potential strikes, especially on the U.S. East Coast, to proactively manage supply chain disruptions.

- Prepare for Tariff Changes: Assess the impact of anticipated tariff increases on your supply chain and consider adjusting procurement strategies accordingly.

- Plan for Lunar New Year Disruptions: Adjust inventory and shipping schedules to account for factory shutdowns and increased demand during the Chinese Lunar New Year period.

- Evaluate carrier partnerships: With the restructuring of major alliances, reassess your carrier partnerships to ensure service reliability and coverage.

- Assess Environmental Impact: Consider the environmental implications of your shipping choices and stay updated on regulatory changes to ensure compliance and sustainability.

By proactively addressing these factors, shippers can navigate the complexities of the 2025 ocean freight landscape, ensuring resilience and efficiency in their supply chains.

(Sources: Bertling, Xeneta, U.S. Chamber of Commerce)