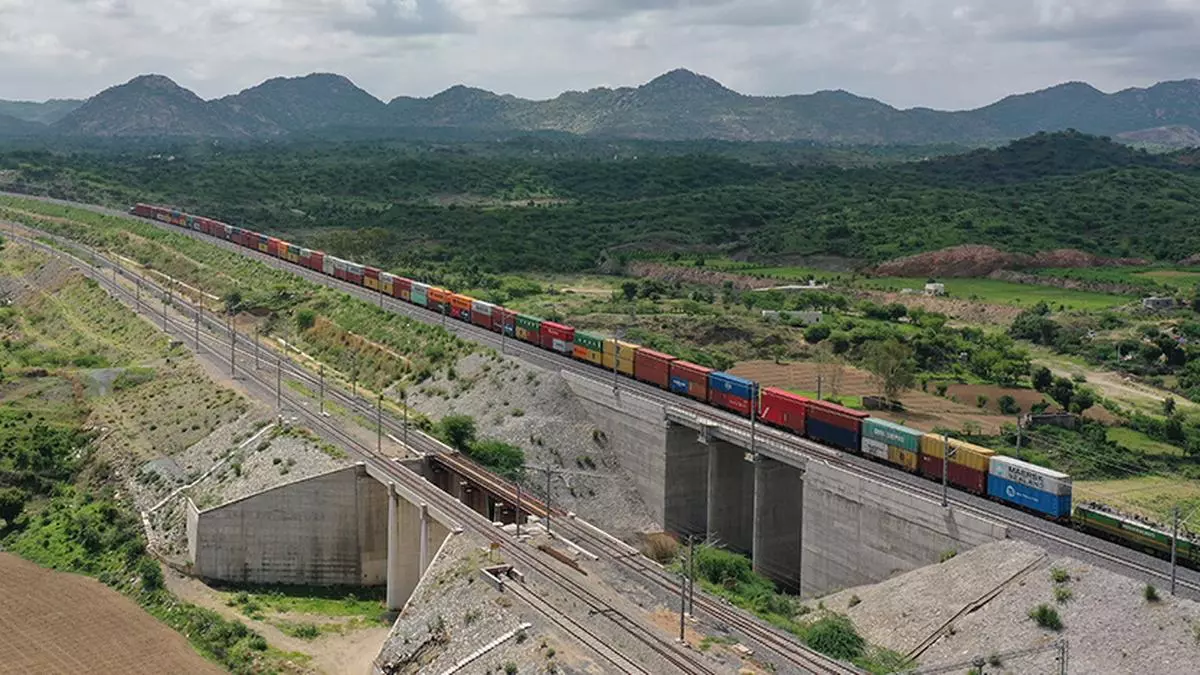

The Dedicated Freight Corridor will no longer face an 18 peercent GST on track access charges starting July 15, 2024.

India’s Dedicated Freight Corridor Corporation of India (DFCCIL), a special-purpose vehicle of the Indian Railways, is set to be exempted from an 18 percent GST, eliminating the need for new revenue models or changes in freight rates.

The tax obligation was previously imposed on track access charges, remittances paid for using the rail network. Estimated remittances under this head were ₹5,000 crore, potentially increasing as more tracks became operational. On July 12, the Central Board of Indirect Taxes and Customs (CBIC) announced the GST exemption on services provided by Indian Railways and Special Purpose Vehicles (SPVs) to the Railways, effective from July 15, 2024.

The exemption covers services provided by SPVs to Indian Railways, including the use of infrastructure built and owned by SPVs during the concession period, and maintenance services provided by Indian Railways to SPVs. This means track access charges, received as remittances from the Railways, will be exempt from GST. Consequently, there is no need to categorise these charges separately for accounting purposes or increase freight rates for corridor users.

Typically, remittances between government entities are exempt from GST. However, DFCCIL, categorised as an SPV, provides track services and is treated as a separate entity. Conversely, the Railways consider DFCCIL as a zone, with its revenue credited to the Railways and funds subsequently remitted. DFCCIL operates on a reimbursement model, primarily funded through track access charges, covering various costs including operations, maintenance, and land lease.

DFCCIL has received loans from multilateral agencies such as the Japan International Cooperation Agency (JICA), aiding its financial stability and operational efficiency. This GST exemption is expected to streamline financial processes and support the corridor’s growth and development.