Xeneta’s report forecasts a booming Q4 for air cargo rates, following six months of double-digit growth, with June volumes up 13 percent.

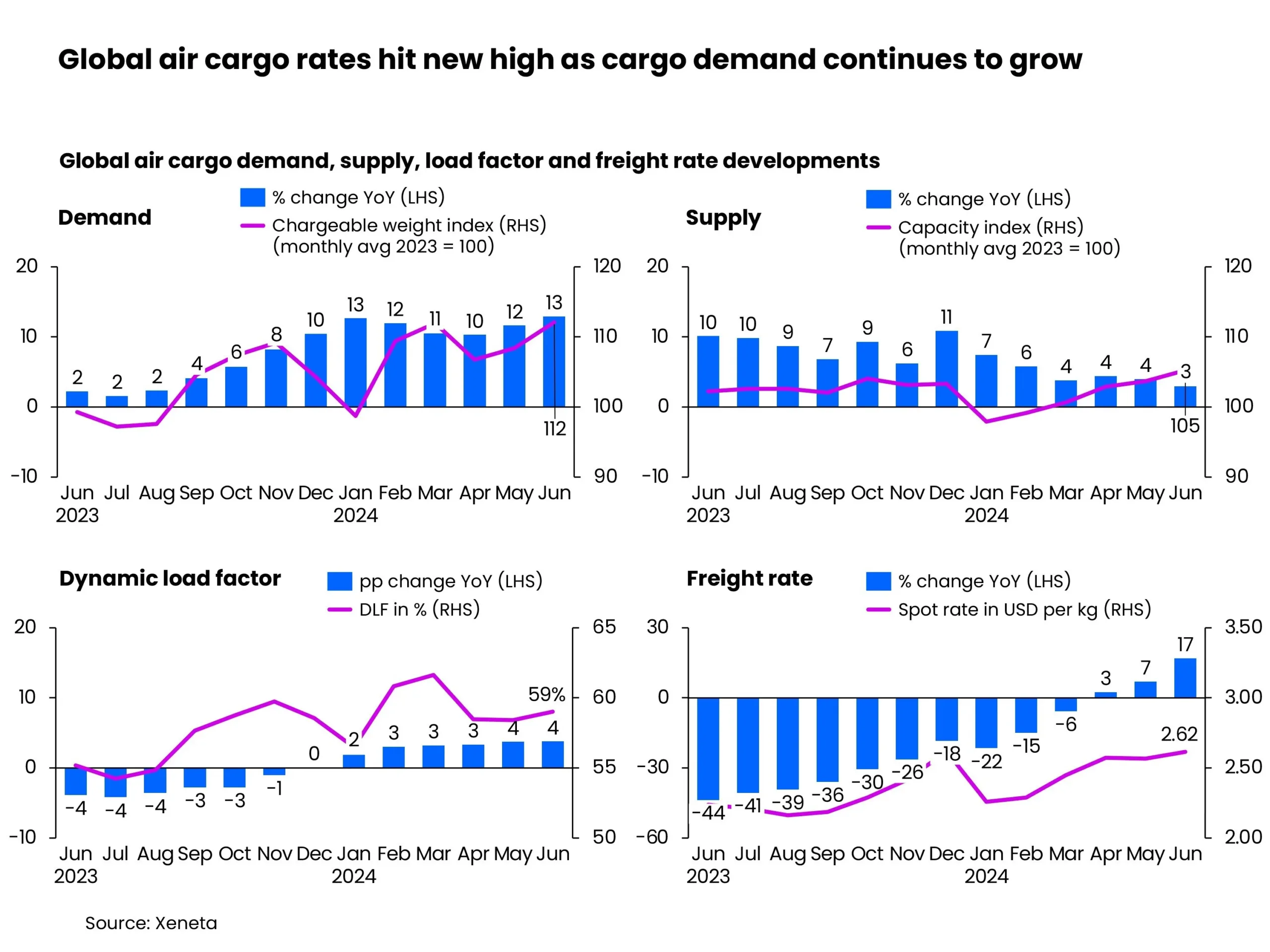

The global air cargo market is on track for a ‘booming Q4’ with significant rate increases, following six consecutive months of double-digit growth, as reported by Xeneta. June’s demand, measured in chargeable weight, rose by 13% year-on-year, continuing the positive trend observed throughout the first half of 2024. In contrast, cargo supply increased by a modest 3% year-on-year, marking the slowest growth rate this year.

As a result, the global air cargo dynamic load factor, Xeneta’s metric for capacity utilisation, saw a 4% year-on-year increase. Niall van de Wouw, Chief Airfreight Officer at Xeneta, emphasised that while the growth in demand is expected to persist into July and August, the market should brace for a significant hike in air freight rates in Q4.

Van de Wouw noted that certain airlines and forwarders are already considering implementing a peak-season surcharge by the end of August. He cautioned shippers who haven’t secured their Q4 capacity, predicting they will face considerable rate increases, especially in Asian markets.

The latest analysis reveals that air cargo spot rates in June recorded the largest increase of the year, rising 17% year-on-year to USD 2.62 per kg. Major contributors to this surge include the e-commerce boom, disruptions in ocean freight due to conflicts in the Red Sea, and improved global manufacturing activities.

Southeast Asia, Europe, and the US markets experienced the most significant spot rate increases, growing 14% to USD 3.65 per kg and USD 5.32 per kg, respectively. However, rates for outbound China markets fell slightly, with China to Europe and the US dipping by 1%.

Market uncertainties persist as the latest Purchasing Managers’ Index (PMI) indicates slower manufacturing production growth in June, alongside a decline in new export orders. Retail sales in the US and Europe remain soft despite cooling inflation.

In response to market volatility, shippers are opting for longer-term contracts. In Q2 2024, contracts lasting more than six months increased to 28%, while three-month contracts decreased, reflecting concerns about renegotiating rates before the year-end peak season.

Van de Wouw advised considering longer-term contracts now to mitigate the expected extreme rate fluctuations, especially given the ongoing ocean shipping issues and manufacturing upturns. He concluded that shipping costs from Asia Pacific are set to rise significantly by September.