In order to cut transportation costs and greenhouse gas emissions, Suzuki Motor is constructing rail terminals inside of two of its assembly factories in India.

Toshihiro Suzuki, president and chairman of the Japanese manufacturer, told in an interview that increasing rail transport was an efficient strategy. Suzuki’s Gujarat plant may start making deliveries by train in the next fiscal year, while the Manesar plant could follow as soon as fiscal 2024.

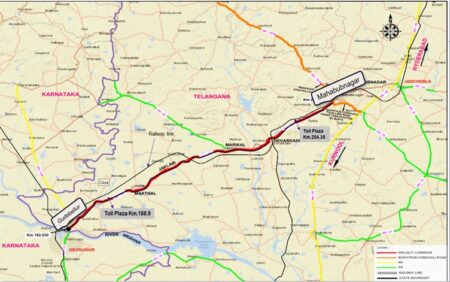

Trucks travel 1,000 to 2,000 kilometres across India as they deliver vehicles to major cities. Fuel costs and tolls have increased for these lengthy trips. India lacks enough highways to accommodate such trucks, and some roads are poorly paved.

Suzuki’s continual change from road to rail freight also helps the company expand its carbon neutrality effort throughout the supply chain.

India accounted for around 60per cent of Suzuki’s production of four-wheeled vehicles and about 50per cent of unit sales in that category during the year ended in March. This equals 1.65 million manufactured and 1.36 million sales vehicles.

The country is Suzuki’s “top earner,” the president said. India generated 33per cent of global revenue, or 1.17 trillion yen ($8.2 billion at current exchange rates), from two-wheelers and motorcycles in fiscal 2021.

In the fiscal year beginning in 2014, Suzuki began transporting finished vehicles using train tracks. By the fiscal year 2021, 1.1 million vehicles had been moved. In the year ended March 2022, the figure grew 20per cent to 230,000 automobiles, representing 15per cent of all finished vehicles carried that year.

“We aim for 30per cent,” President Suzuki said, indicating that the ratio will double in five years.

The Gujarat plant in western India can produce 750,000 vehicles a year. The facility already transports some vehicles by rail, but that involves ferrying the autos by road to a nearby train station — an inefficient process.

A train track is located close to the factory. Suzuki will convert just over 20 km of that line into wide-gauge tracks designed for freight transport. The company will install almost 3 km of new rail that connects to the assembly plant loading terminal.

Indian investments in rail infrastructure have stalled behind those in road building. Trains have occupied a smaller proportion of freight transport in recent years than during the 1990s, while small trucks make up the major share of cargo shipments. These variables have contributed boost transit prices.

Following consultation with several parties, including the Society of Indian Automobile Manufacturers, the state-run Indian Railways upgraded train carriages intended to transport cars. The share of passenger vehicles transported by rail climbed to 16per cent in fiscal 2021 from 1.5per cent in fiscal 2013, the Ministry of Railways announced.

Indian automakers such as Tata Motors have begun to utilise railways. However, Suzuki — India’s largest car maker, with a market share of more than 40per cent in passenger vehicles — wields considerable influence on the shift toward rail deliveries.

In India, Indian Railways is responsible for operating the engine car and maintaining the rails, while freight carriages and loading terminals are handled by transport companies. Foreign companies, such as Japan’s Konoike Transport, are also entering this market. The construction of specialised freight rail lines is now underway.