Flights and cargo routes are set to stabilise as India and Pakistan agree to a ceasefire; recovery is expected by May 20.

Following a mutual ceasefire agreement between India and Pakistan across land, sea, and air, global shipping and air traffic are expected to stabilise by May 20, according to industry insiders. The two-week disruption in international supply chains, triggered by the post-Pahalgam terror attack escalation, caused widespread delays in cargo movement, airline operations, and e-commerce deliveries.

Airports in conflict-prone zones, including Jammu & Kashmir and Punjab, resumed operations on May 12. However, Indian airlines are now facing a logistical challenge as they work to recalibrate passenger and cargo flight schedules and clear the backlog of cancellations. As of May 12, over 2,500 domestic flights had been cancelled since May 8 due to airspace closures, affecting 32 airports and rerouting hundreds of international flights.

Despite Pakistan reopening its airspace to civil aircraft via a NOTAM on May 11, the overflight ban on Indian aircraft remains active. Roughly 20% of Indian carriers’ West Asia routes and 30% of Europe/North America routes use Pakistani airspace, forcing reroutes that add 15 minutes to 1.5 hours in flight time — significantly impacting costs and schedules.

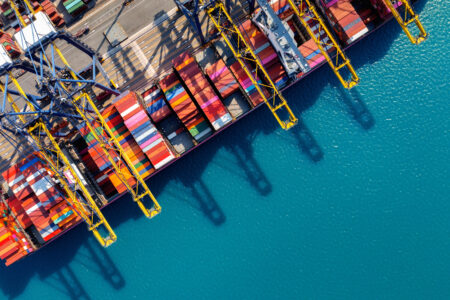

On the maritime front, regional trade took a hit as global shipping lines halted services to Karachi Port, redirecting cargo to alternate transshipment hubs like Colombo. Mundra and Kandla ports in India resumed operations by May 9, though Kandla is grappling with congestion. DPA is actively reassuring global carriers about safety and efficient handling at Indian ports.

Major shipping lines such as COSCO, OOCL, CMA CGM, and Maersk either suspended or restructured services in the region. CMA CGM has announced a geopolitical surcharge of up to $800 per unit for cargo to and from Pakistan, effective May 15, with further hikes for other regions from June 6.

MSC is now using Colombo as a new hub to handle India-Pakistan cargo, while COSCO has rerouted vessels originally bound for Karachi to alternative ports such as Port Klang. Containers stuck at Karachi due to missed connections and port backlogs are compounding delays and causing further shipment rollovers.

E-commerce companies say warehouses can support demand for another week, cushioning last-mile disruptions. However, India’s MSME exporters, already under pressure from Red Sea disruptions and US tariffs, are bracing for longer recovery cycles.

Logistics experts say normalcy depends on successful DGMO-level talks between India and Pakistan, which commenced on May 12. While recovery is underway, full restoration of international logistics and air connectivity is expected only by the end of the week.

Source: Maritime Gateway