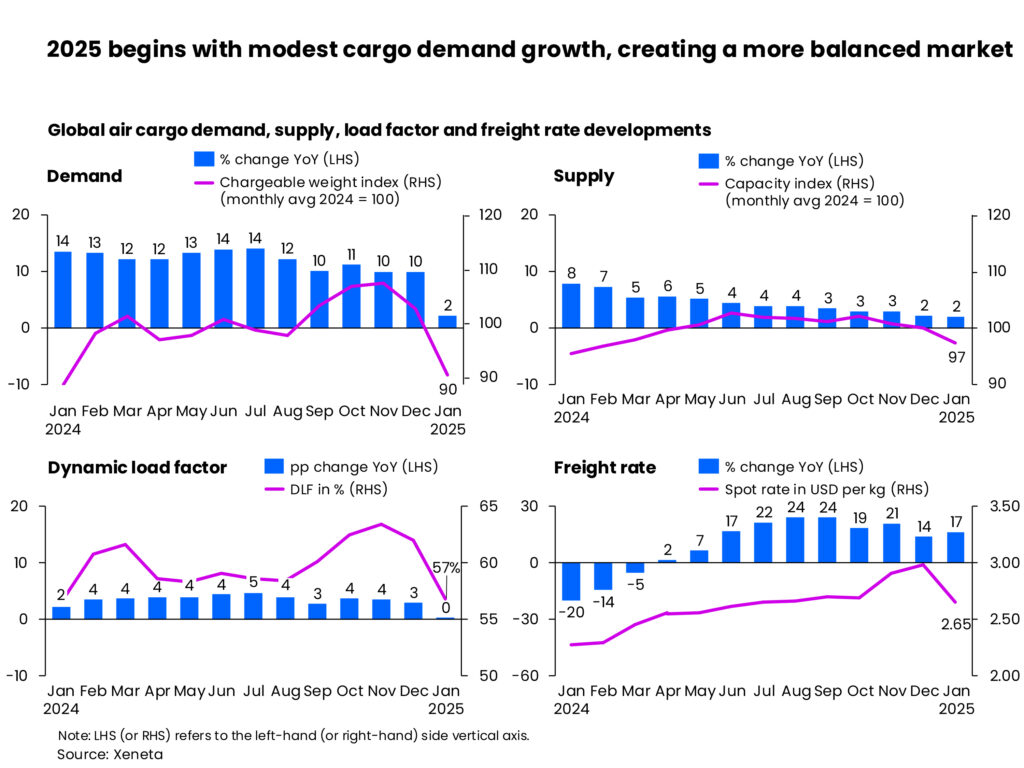

Global air cargo demand grew just 2% in January, with concerns over tariffs and trade disputes clouding industry forecasts.

The global air cargo industry experienced a slower-than-expected start in 2025, with demand rising only 2% year-on-year in January. Analysts attribute this to an earlier Lunar New Year and a high comparison base from 2024, though uncertainty over US-imposed tariffs and potential retaliations is adding to industry concerns.

Despite the sluggish start, experts at Xeneta maintain a 4-6% growth forecast for the year, emphasising that tariff negotiations remain fluid. The US has introduced new tariffs targeting China, prompting countermeasures from China, Canada, and Mexico. Analysts warn that while a full-scale trade war remains uncertain, the unpredictability is hampering investment and long-term planning.

E-commerce, a key driver of air cargo growth, could also face turbulence. In 2024, shipments from China to the US accounted for 25% of total global sales and filled over half of cargo capacity between the two nations. If the US removes the de minimis exemption—allowing duty-free imports under a certain value—it could significantly impact air freight volumes. While price increases may not deter demand, potential customs delays could disrupt e-commerce’s appeal.

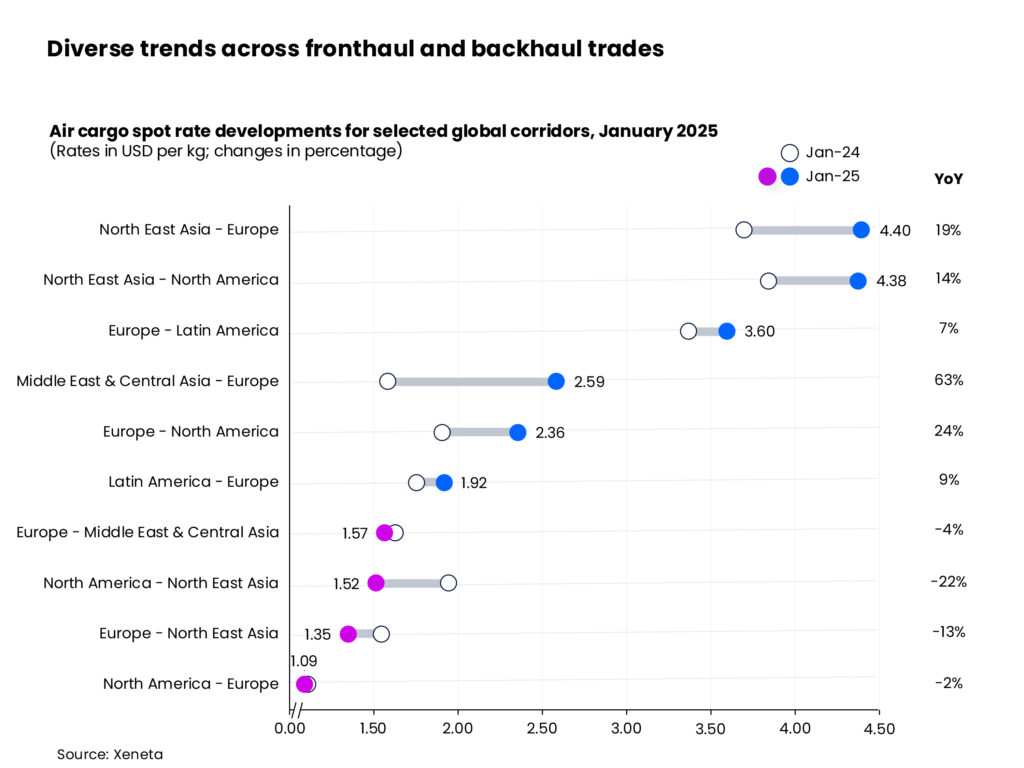

Air cargo rates remain elevated, with global spot rates 17% higher year-on-year at $2.65 per kg, largely due to e-commerce demand and capacity constraints. Trade disruptions in the Red Sea have further driven up rates, particularly from the Middle East and Central Asia to Europe, where rates surged 63% to $2.59 per kg.

Despite market uncertainties, analysts advise shippers to remain adaptable rather than make drastic changes. While tariff negotiations unfold, the industry continues to navigate an unpredictable landscape, with cautious optimism for sustained growth.Source: Xeneta