US tariff hikes and de minimis rollback spark fears of e-commerce crash and air cargo chaos in 2025.

The global air cargo industry is bracing for heavy turbulence as the United States rolls back its de minimis threshold on shipments from China and imposes steep new tariffs—a move expected to significantly disrupt e-commerce flows and global trade lanes.

From May 2, low-value imports from China and Hong Kong, previously duty-free under the $800 de minimis rule, now face up to 145% tariffs, with postal shipments taxed at 120% or a flat fee of $100 (doubling to $200 on June 1).

What’s at Stake:

- An estimated 1.35 billion small parcels enter the US annually under this exemption.

- Nearly 50% of air cargo on the China–US route is e-commerce driven.

- The move threatens 6% of global air cargo volume.

Freighter cancellations and network adjustments have already begun. E-commerce giant Temu is reportedly slashing ad spend in the US as demand weakens.

“This is not just about one sector. Entire trade lanes are under stress,”

says Niall van de Wouw, Chief Airfreight Officer at Xeneta.

April Market Snapshot:

- Global volumes: +4% YoY

- Spot rates: +3% YoY, limited by a -24% drop in jet fuel prices

- Capacity: +3% YoY

- Load Factor: down to 57%

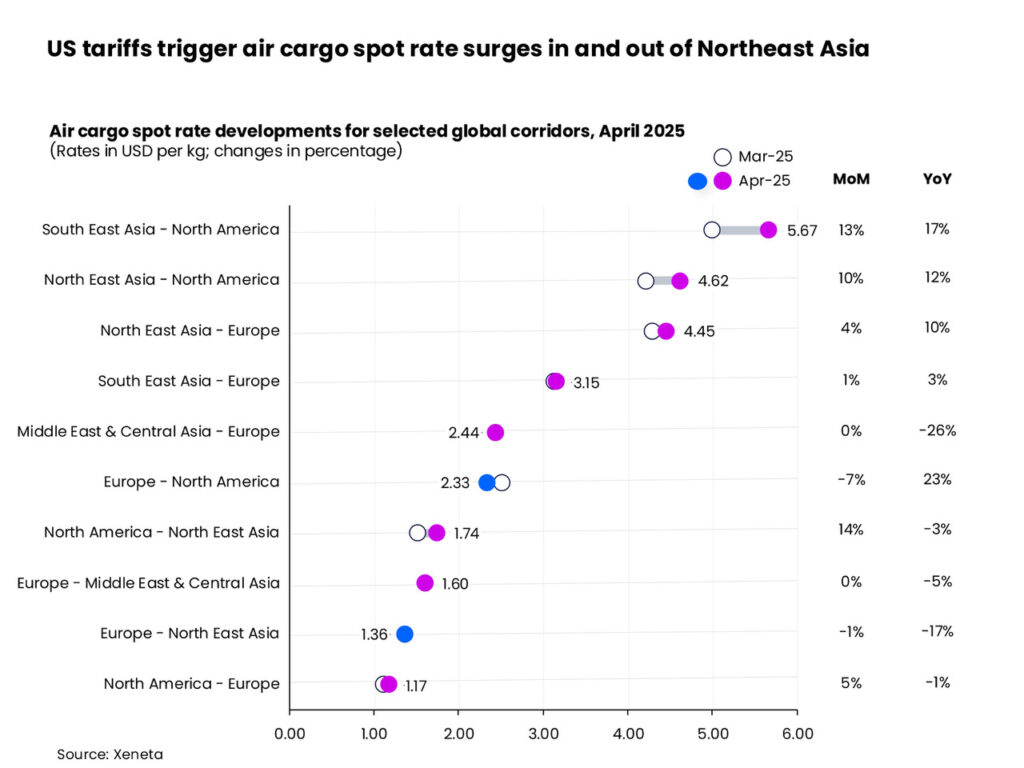

While early-April panic shipments pushed rates up by 13% (Southeast Asia–US) and 10% (Northeast Asia–US), these gains reversed rapidly after a 90-day pause and China’s retaliatory tariff news.

“We’re entering the ‘calm before the storm’… and it could be a mess,”

van de Wouw added.

Forecasts for 4–6% growth in 2025 are now “meaningless,” as macroeconomic uncertainty clouds visibility. Lower freight rates may benefit some shippers, but most won’t recover tariff costs.

Real Impact:

A $19.49 item from China now costs $48.38 on Temu after tax and shipping—signalling the end of “free shipping” expectations for US consumers.

“The traditional airfreight market won’t fill the void.

Shippers may get more capacity—but only if trade stays viable.”

As carriers begin redeploying aircraft and reshuffling capacity, global supply chains are once again at a crossroads. The question now: How bad will it get?

Source: Xeneta