March witnessed an 11 percent surge in global air cargo demand, driven by e-commerce and Red Sea concerns, according to Xeneta data.

Global air cargo market demand continued its upward trajectory, experiencing an impressive 11 percent year-on-year growth for the third consecutive month in March. This surge, reported by Xeneta’s latest weekly market data, came as a surprise bonus for forwarders and airlines amid concerns over the impact of conflict in the Red Sea region on ocean freight services.

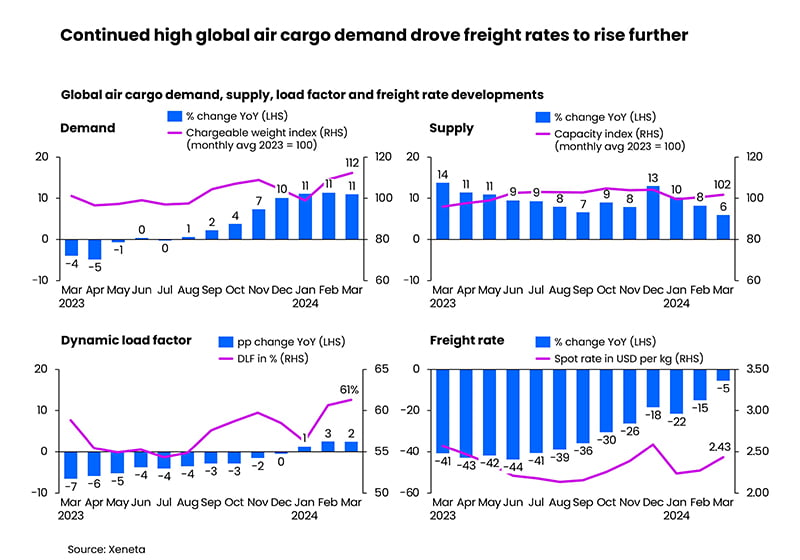

Despite traditionally being weaker months for the airfreight industry, the higher volumes in the first quarter of 2024 outpaced the growth in capacity supply, which increased by 8 percent year-on-year. Consequently, the global dynamic load factor, a measure of cargo capacity utilisation based on volume and weight of cargo flown alongside available capacity, jumped by 2 percentage points year-on-year to reach 59 percent in the opening three months of the year. March performance showed a similar trend, edging up to 61 percent.

Niall van de Wouw, Xeneta’s chief airfreight officer, remarked on the unexpectedly busy airfreight market, suggesting that it doesn’t indicate a market running out of steam. He attributed the growth to increased volumes from the Middle East and South Asia as shippers shifted services from the ocean to the air to avoid delays in the Red Sea.

Spot rates also saw a significant increase, rising by 7 percent from the previous month to USD 2.43 per kg on average globally in March. Notably, the Middle East and South Asia-to-Europe market led the growth, with rates soaring by 46 percent over February’s levels. The India outbound market witnessed a staggering 68 percent increase in spot rates to USD 3.38 per kg.

In contrast, the South American outbound market experienced a decline in rates due to easing floral market demand, with spot rates dropping by 12 percent to USD 1.25 per kg for air cargo bound for the US.

Freight forwarders showed a preference for the spot market, accounting for 43 percent of total volumes in the first quarter, compared to 31 percent in the pre-pandemic era. This shift was accompanied by a trend towards shorter-term contracts, with three-month contracts accounting for 41 percent of all newly negotiated contracts in the first quarter.

While the air cargo market has enjoyed robust growth for six consecutive months, uncertainties remain regarding future trends. However, current indicators suggest that airfreight demand remains resilient, driven by factors such as e-commerce growth and ongoing concerns about global trade routes.