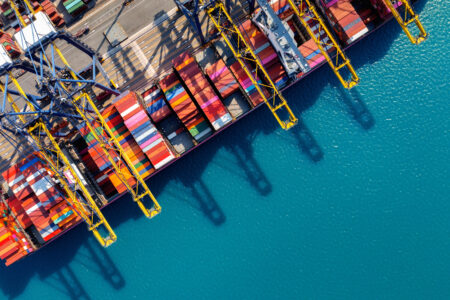

India’s major ports are stepping up with increased capacity utilisation and efficiency. Backed by strong policy reforms, digitalisation, and public-private partnerships, they’re shaping the future of India’s maritime logistics ecosystem.

Major ports’ automation, PPP model boost capacity utilization and export growth

India’s extensive coastline of 7,517 km, spanning nine states and four Union Territories, serves as a strategic asset for the nation’s maritime and trade infrastructure. Port governance in Bharat is a concurrent subject, jointly managed by the central and state governments. The Central Government administers 12 major ports under the Major Ports Act, 2021, while non-major ports fall under state or union territory jurisdictions via their respective port directorates or maritime boards.

PPP evolution

Since liberalisation in 1991, major ports have operated under the “Landlord Model,” leasing terminals and waterfronts to private players through Public-Private Partnerships (PPP). State Maritime Boards adopted the Build-Operate-Transfer (BOT) model, formalised through a Model Concession Agreement crafted in 2008 and later revised in 2022. This dual approach fostered private participation and infrastructural modernisation.

Investment push

In recent years, the government has aggressively pursued reforms to draw private and foreign investments into the sector. These include 100% FDI via the automatic route, income tax incentives under the Income Tax Act, 1961, and permissions for joint ventures involving major ports, non-major ports, and private entities. These policy measures align with broader strategies laid out in Maritime India Vision 2030 and Amrit Kaal Vision 2047, with targets to surpass 3,000 MMT in port capacity by 2030.

Port infrastructure

India currently hosts 12 major ports and 217 non-major ports, of which 64 non-major ports are operational, bringing the total to 76 functional ports. Notably, the Vizhinjam transshipment port became operational this year. A mega port at Vadhavan has received Cabinet approval, while another is being planned in the Andaman & Nicobar Islands.

Performance metrics

In FY 2024–25, major ports handled 855 MMT against a capacity of 1,630 MMT, reflecting 52% utilisation — a 4% increase over the previous year. Over four years, capacity has risen from 1,560 MMT in FY 2021 to 1,630, while cargo throughput has grown from 592 MMT to 855 MMT, a 7% CAGR.

Non-major ports, meanwhile, expanded capacity from 995 MMT in FY 2021 to 1,080 MMT in FY 2025, a 5-year addition of 85 MMT. Their cargo throughput rose from 740 MMT, showing a 5% CAGR and 68.5% capacity utilisation.

Emerging insights

Despite the historical assumption that the State Maritime Boards’ BOT model was more efficient, recent data suggests otherwise. Major ports — especially Kandla, JNPA, and Paradeep — have demonstrated superior operational efficiency, capacity use, and cargo throughput, thanks to increased automation and performance-driven management.

For policymakers, this marks a pivotal shift — signalling that major ports are not just catching up but leading India’s maritime logistics transformation.