Many retailers closed their outlets during the initial COVID-19 wave as their revenue was immediately reduced. However, it progressively began to acclimatise. According to the India Brand Equity Foundation, a government export promotion organisation in India, online retail penetration is predicted to increase from 4.7per cent in 2019 to 10.7per cent by 2024. As a result, many retailers have begun developing click-and-collect services and forming partnerships with logistics firms to keep their businesses afloat. Retailers are working with logistics providers to help corporations and retailers with order deliveries as the need for door-to-door delivery has increased.

In accordance with the Federation of Indian Chambers of Commerce and Industry (FICCI), a non-governmental trade association and advocacy group located in India, the retail market in India is predicted to develop at a CAGR of 10per cent and reach US$1.6 trillion by 2026. The Indian retail market accounts for 10per cent of the GDP and about 8per cent of employment in the nation. India is the fifth-largest international retail market, which has attracted several fresh ventures. Online retailers are predicted to have rapid growth on par with traditional stores during the next five years.

It is anticipated that this will have a good impact on the Indian e-commerce logistics sector because online retailers are more dependent on 3PL service providers.

Classification of the Indian e-commerce logistics sector

The Indian e-commerce logistics market is divided into several categories, including service (transportation, warehousing, and inventory management), value-added services (labelling, packaging, etc.), business (B2B and B2C), destination (domestic and international/cross-border), and product (fashion and apparel), consumer electronics, home appliances, furniture, beauty and personal care products, and other products (toys, food products, etc.). For each of the segments, the study provides a market size and forecast in dollars (USD billion). The report also discusses the impact of COVID-19.

E-commerce sales growth is driving the market ahead.

According to the India Brand Equity Foundation, the Indian e-commerce sector is rapidly expanding and is predicted to surpass the United States to become the world’s second-largest e-commerce market by 2034. India’s e-commerce market is predicted to develop at an 18.4per cent CAGR to reach US 197 billion by 2027, up from US 66.76 billion in 2021.

The online retail sector enables sellers to sell on a global scale and market their products using marketing tools that assist in the creation, execution, and analysis of campaigns on Facebook and Google. Sellers may manage orders, shipping, and payments from a single dashboard, which is quite versatile. The same-day delivery method and flexible options have improved consumer experiences in eCommerce stores. Because of these efficiencies, e-commerce sales have been steadily increasing in recent and subsequent years.

The number of firms entering the e-commerce market is gradually expanding due to the expectation of greater internet penetration and smartphone users. Online retailers are collaborating with third-party logistics (3PL) firms to address delivery difficulties such as inventory, packaging, shipping, warehousing, and tracking. This immediately contributes to the earnings of the logistics sector.

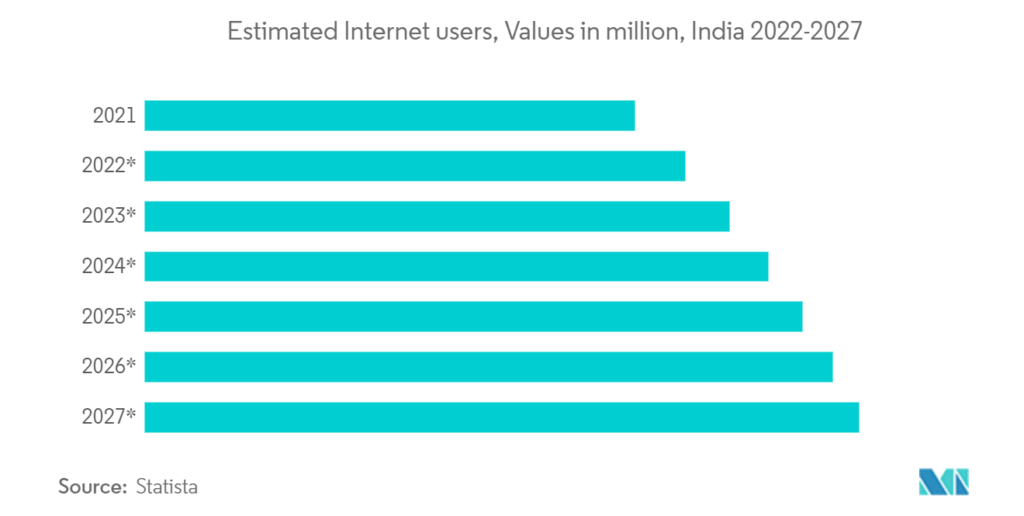

Increase in internet users in India

According to Statista, the number of internet users will reach 1,232.33 million by 2027. It is expected to rise in both urban and rural areas, demonstrating a rapid rise in internet access. According to a survey by the Internet and Mobile Association of India (IAMAI), India is the world’s second largest internet market, trailing only China. The number of users has gradually increased as mobile connectivity has improved, women’s purchasing habits have improved, and rural penetration has expanded.

According to information from the India Brand Equity Foundation, the Digital India initiative has increased the number of internet connections to 830 million by 2021. 55per cent of all connections to the internet were in metropolitan areas, and 97per cent of those connections were wireless. In 2021, the whole smartphone market in India expanded by 7per cent. By 2030, there will likely be 887.4 million smartphone users in India, a significant indication of the growth in the market. With 14.1 GB of data used per person per month, India has the highest data consumption rate in the world.

A Snapshot of the Indian E-Commerce Logistics Industry

The Indian e-commerce logistics market is considered to have a fragmented competitive environment. As the need for logistics services increases rapidly throughout the area, businesses are vying for market share. 100per cent FDI in B2B e-commerce is now permitted thanks to government policy backing, and the recent increase in digital literacy has encouraged new multinational businesses to establish bases in India. As a result, the global logistics market has started to strategically invest in building a regional logistics network by developing new distribution centres and smart warehouses, for example. Leading participants in the market include FedEx Corporation, DHL, Aramex, etc.

Leaders in the Indian E-commerce Logistics Market

- Delhivery

- FedEx

- Ekart

- DHL

- Gati

*Disclaimer: Major Players sorted in no particular order

Indian E-commerce Logistics Market Updates

As of June 2022, Delhivery (an Indian logistics and supply chain startup) will offer guaranteed same-day delivery (SDD) service in 15 cities. Delhivery also aims to assist brands in cultivating long-term client loyalty. Delhivery has worked with brands to identify SKUs that sell quickly and stores them in warehouses near the final consumers. Delhivery’s technology will display the quickly moving SKUs available for same-day delivery when the consumer places the order for the same.

Until July 2022, Panattoni, a key leader in the development of industrial and logistics real estate, was going to spend $200 million in India to build four industrial and logistics parks spread across important cities like Delhi, Mumbai, Chennai, Hyderabad, Bengaluru, and Pune. To establish four industrial and warehouse buildings on 250 acres of land for an integrated park, the company is in talks with the landowners.