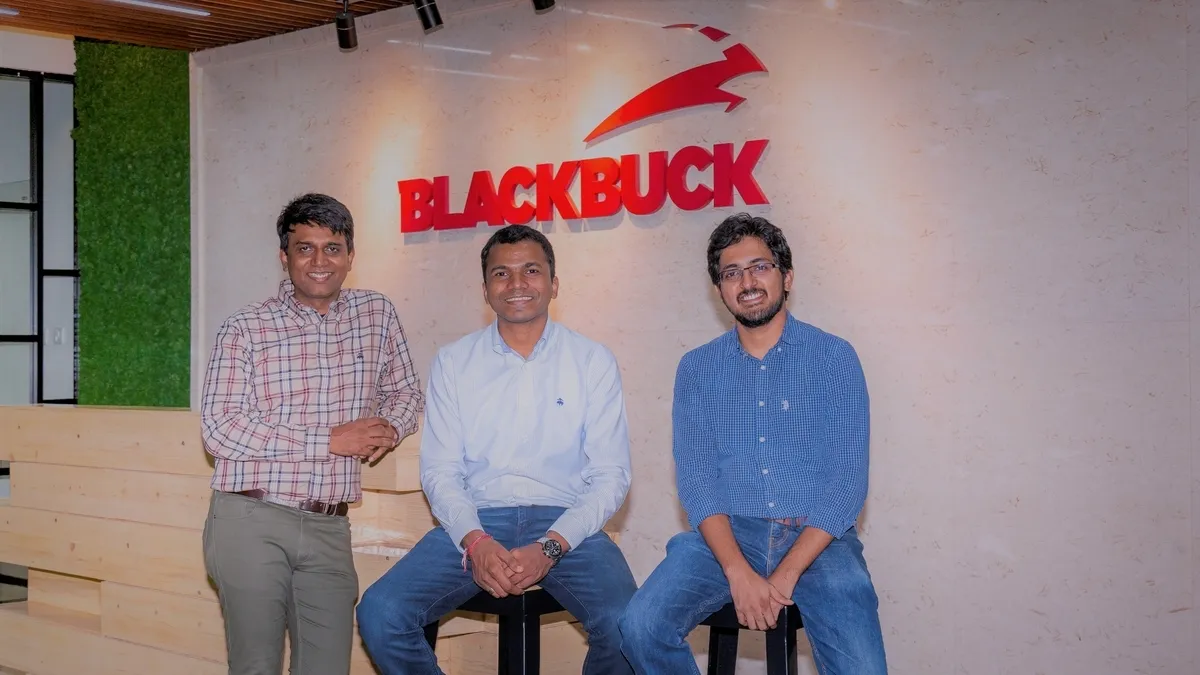

BlackBuck, the logistics startup supported by Flipkart, is gearing up for an IPO in the upcoming fiscal year, aiming to raise a substantial $300 million.

BlackBuck, the logistics startup with backing from Flipkart, is charting its course towards an initial public offering (IPO) in the next fiscal year, with aspirations to secure funds amounting to $300 million. In preparation for this milestone, BlackBuck has engaged merchant bankers and legal advisors to guide through the IPO proceedings, with a draft red herring prospectus in the works.

Established in 2015, BlackBuck operates as a B2B online trucking platform, connecting businesses requiring shipping services with truckers. Beyond its core offerings, the platform provides additional services such as the sale of GPS tracking devices, FASTags, and fuel cards. The diverse clientele includes major companies like Hindustan Unilever, Reliance Petrochemicals, Hindustan Zinc, and Marico.

The IPO structure will involve a mix of a fresh issue of shares to generate capital and a secondary sale of shares by existing investors. The final scale of the offering hinges on the magnitude of the secondary share sale, a matter still in early-stage discussions between the company and its investors.

Proceeds from the IPO are earmarked for expanding BlackBuck’s services business, a recent focal point, and fostering growth in its core freight business. The logistics startup achieved unicorn status in 2021, securing $67 million in its Series E funding round.

While BlackBuck faced a 15 percent decline in consolidated revenue in FY23, with a marginal increase in losses, the IPO comes at a crucial juncture for the startup amid a challenging funding landscape for tech startups since 2022.

Despite these challenges, optimism prevails in the Indian IPO market, with various tech companies like Ola Electric, Go Digit General Insurance, FirstCry, Swiggy, and PayU reportedly gearing up for IPOs, hinting at a potential resurgence in the IPO landscape for new-age technology firms.